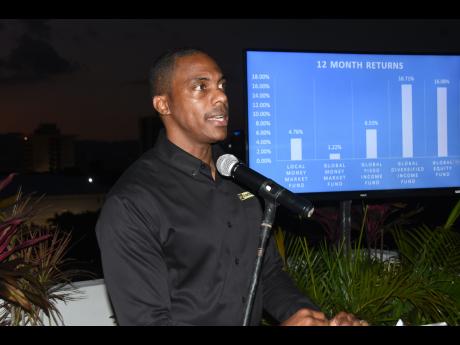

Mutual Funds make sense for investors because they are able to select the type of funds that serve their individual risk tolerances, says Jermaine Deans, deputy general manager at JN Fund Managers (JNFM).

“The addition of the new Global US Dollar Fixed Income Fund to the five existing funds offered by JN Fund Managers is an example of the options this investment category gives to investors,” Mr Deans told managers from across The Jamaica National Group.

He was briefing JN managers at an update about the new products and services being offered by the fund management company at its headquarters in New Kingston, on March 22.

“Mutual funds and unit trusts represent the direction in which the Bank of Jamaica (BOJ), the Ministry of Finance & The Public Service and the International Monetary Fund (IMF) are trying to nudge the financial market,” he said. “They open up the market to greater participation and also offer enhanced security.”

JN Fund Managers launched five original mutual funds in 2016, with its Local Money Market fund requiring an initial investment of J$10,000, while their previous minimum investment for retail repurchase agreements was J$1 million.

MINIMUM INVESTMENT

The Global Money Market fund has a minimum investment threshold of US$1,000, while the Global Fixed Income, Global Diversified Income and Global Equity funds each have a minimum initial investment amount of J$50,000.

“These funds are based in Jamaica but also give you exposure across the region and the globe,” Deans said. “Therefore, the average investor can access much wider options than before.”

Delories Jones, senior vice-president, sales and client experience, at the investment firm, explained that “such funds use the concept of pooling savings collected from various investors to purchase stocks, bonds, money market instruments, and other assets.”

She pointed out that, “We have something for everyone across the risk spectrum. A fund is available for the low-risk investors, who want to ensure that their principal is secure while they earn some interest; and, there are options for those who are ready to take on a more aggressive stance.”

And she also advised that with the mutual funds, “You don’t have to worry about the intricacies of buying an individual stock, or real estate. Instead, you can receive good returns, transparent transactions, and the ability to cash in your funds in three days.”

Sharon Smith, head, Individual Retirement Scheme and Premium Financing at JN Bank, advised that, “mutual funds are becoming a more popular option. For the same sum invested, you can now develop a far more diverse portfolio, which allows you to better tailor your choices. In addition, you can more easily add to your investment portfolio, as the threshold required is lower.”

“There is a shift that is taking place from the traditional investments in reverse repurchase Instruments and bank CDs to mutual funds and unit trusts,” Smith stated. “For the average investor, the increased opportunity this offers is a positive development.”

Leave A Comment