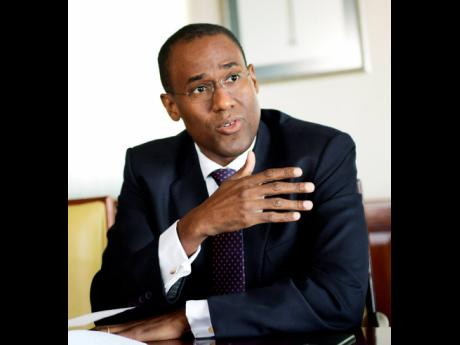

The microfinancing bill that will bring small lenders under the regulatory umbrella of the Bank of Jamaica has been tabled in Parliament by Minister of Finance Dr Nigel Clarke, who says it’s meant to bring order to the market and constrain the predatory lending practices employed by some.

The legislation covers micro lenders that provide loans to individuals and small institutions whose sales range up to $425 million.

The bill does not identify BOJ as the regulator – it speaks only of a ‘supervisor’ – but the central bank confirmed Thursday that it was the intended oversight authority.

In his statement accompanying the tabling of the bill, called the Micro Credit Act, Clarke said there has been a proliferation of microlenders since 2003, many of which “charge excessive interest rates and engage in predatory lending practices”.

Industry representatives were still reviewing the legislation this week to understand its full ramifications. Reactions were promised for later.

Microlenders, which are also referred to as payday lenders, are known to charge interest rates ranging from around 40 per cent upwards, but they are reports that some charge rates of up to 70 per cent and beyond.

The new bill proposes to reign in that practice by tagging microloan rates to the Government of Jamaica’s Treasury bill rates, taking into consideration “cost of funds, profit margins, borrowers’ credit risk, administrative costs and other loan-related costs”. And the companies will have to seek a licence from the supervising authority to issue loans when the law and its regulations come its force.

Treasury bill rates are currently yielding below three per cent interest per annum, which offers a signal that the Government is looking for deep adjustments to the loan rates.

Those firms that lend without a licence will not be able to enforce their loan contracts with borrowers. And only registered companies with proper articles of incorporation, financial records, a board of directors, and office and branch locations can qualify for a licence.

Leave A Comment