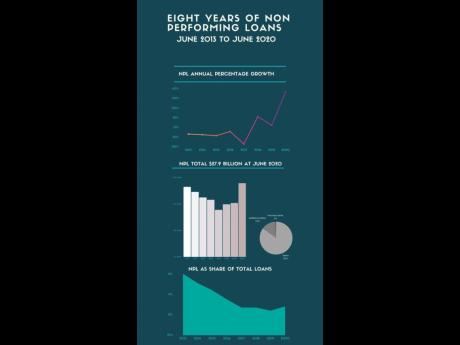

Unserviced bank and mortgage loans grew by one-third to $27.9 billion over the span of a year ending June, according to new central bank data.

It’s the highest percentage rise in eight years and, as a dollar value, grew by $7.5 billion from $20.4 billion a year earlier. The unserviced debt, also called non-performing loans, or NPLs, reflects the increased economic challenges faced by borrowers amid job losses and lay-offs linked to the coronavirus.

The growth in NPLs across commercial banks alone was 32.8 per cent, to $24 billion. The data did not disaggregate whether personal or commercial loans were hardest hit. Building societies, which distribute mortgage loans, saw their NPLs spike by 67.3 per cent to $3.9 billion.

The January-March 2020 period was the first quarter that witnessed a double-digit rise in NPLs in years, and the deterioration continued into the June quarter.

Jamaica’s economy has been contracting since the coronavirus was detected on the island in March. The June quarter was especially bad, having contracted 18.4 per cent as reported this week by the Statistical Institute of Jamaica, Statin – a historically dire performance. It affirmed the preliminary estimates of an 18 per cent second-quarter contraction by the Planning Institute of Jamaica.

http://jamaica-gleaner.com/article/business/20201002/sharp-rise-loan-defaults-economy-falters

Leave A Comment