Blo omberg , in one of its latest reports, titled, Caribbean Tax Havens Fret They’re at Risk from Global Crackdown, suggests that the global minimum tax, a new corporate tax regime under discussion among G20 countries, has the potential to derail some Caribbean countries which operate as tax havens.

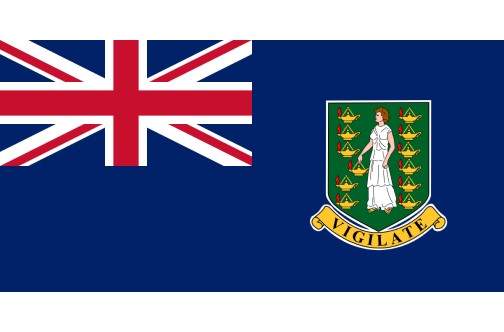

Under the proposal, companies will have to pay 15 per cent tax regardless of where they are incorporated. While the new tax system is yet to be approved by G20 countries, it is cause for scalp scratching among several Caribbean countries – including The Bahamas, the Cayman Islands, the British Virgin Islands, and Bermuda — where companies are able to operate with little or no taxation.

Leave A Comment