Published:Wednesday | November 4, 2015

Finance Minister Dr Peter Phillips signalled the Government’s intent on Tuesday to pursue a new round of divestment of state-owned enterprises via the stock market, but stopped short of giving timelines or a full list of assets to be taken to market, which is now being considered by the Cabinet.

At the same time, the minister of finance was confident that Jamaica would, for the 10th straight quarter up to the end of September, meet the performance criteria under its economic reform agreement with the International Monetary Fund (IMF), quipping that he now approached these tests “with less trepidation” than he did his mock exams in high school.

An IMF review team is due in the island this week.

Phillips also indicated that the administration was preparing for an accelerated reform of the public sector, but stressed that the process was not predicated on cutting jobs, to become “more effective and efficient” to enhance Jamaica’s global competitiveness.

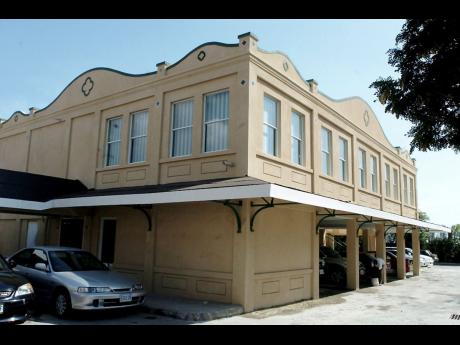

The minister raised these issues in the context of the formal launch of a change management consulting firm, Moneague Consultants, and the observation by its managing partner, Robert Drummond, of the need for public sector entities “to undergo major change in order to strengthen their effectiveness … especially during these times of disciplined constraints”.

Drummond’s partners in the venture is the husband-and-wife team Walter Scott and Keisha Scott, while former GraceKennedy executive James Moss-Solomon is an independent board member.

In his remarks at Moneague’s breakfast launch, Phillips noted the Port Authority of Jamaica’s recent divestment of the Kingston Container Terminal (KCT) to the French shipping ping consortium, Terminal Link/CMA CGM, as well as the imminent lease of Kingston’s Norman Manley International Airport to private operators, for which at least two of the bidding consortiums have substantial Jamaican participation. More divestments were in train, he said.

record high

“We are exploring the use of the stock market for some of the other entities … especially when the index is at record levels,” he said. The Jamaica Stock Exchange main index is trading above 132,000 points, having bested its decade-old record high of 120,592 points in mid-October.

Phillips later indicated that active work was being done, but declined to speak to the specifics in the absence of a clear imprimatur from the Cabinet on the specific entities that would be up for sale and what effort would be applied to each.

He, however, identified the Petroleum Corporation of Jamaica’s (PCJ) 38.7-megawatt Wigton Wind Farm a 24-megawatt expansion is under way as well as the government’s 19 per cent stake in the in the power generator and monopoly electricity transmission and distribution company, Jamaica Public Service, as possible candidates.

While the former Golding administration talked of using the domestic stock market for government divestments, a follow through by the Simpson Miller Government would be the only time since Edward Seaga’s mid-1980s initial sale of the National Commercial Bank and Caribbean Cement Company that the local stock exchange would be employed in such a fashion.

Leave A Comment