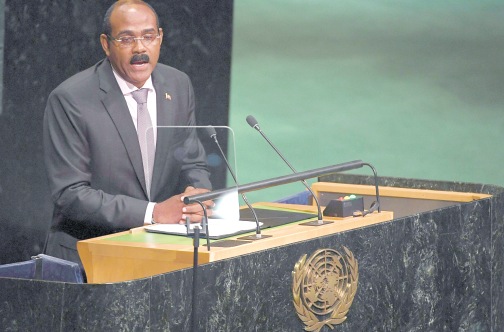

BROWNE… we have always taken the position that we reserve the right to call off the referendum

WASHINGTON, DC, United States (CMC) — The International Monetary Fund (IMF) says financial fragilities occasioned by the decrease in the number of correspondent banking relationships (CBRs) could undermine the long-run growth and financial inclusion prospects of countries affected by the withdrawal of CBRs.

Correspondent banks, which are mainly large, international banks domiciled in the United States of America, Europe and Canada, provide Caribbean states with vital access to the international financial system by offering services to smaller, domestic banks and financial institutions to complete international payments and settlements.

However, many banks which provide correspondent banking services have been seeking to manage their risks by severing ties with institutions in the region.

The issue of corresponding banking was a major item at the annual summit of Caricom leaders in Guyana last July and Antigua and Barbuda’s Prime Minister Gaston Browne, who is spearheading the region’s response, has warned that the Caribbean “must work collectively… to address this threat to our survival”.

Leave A Comment