Co-Chair of the Economic Programme Oversight Committee (EPOC) Keith Duncan has expressed confidence that the Bank of Jamaica’s planned multiple-priced foreign exchange (FX) auction will create more efficiency in forex market transactions. The Government of Jamaica, with a view to creating exchange rate flexibility, has signed off on the International Monetary Fund (IMF) recommendation to introduce a forex auction to smooth excessive currency market volatility.

The move, the IMF says, is an important component to successfully move to inflation targeting, which is aimed at sustaining Jamaica’s monetary and financial resilience. To further strengthen FX markets through greater price discovery and transparency, the Bank of Jamaica will gradually phase out the use of surrender requirements and instead establish multiple-price FX auctions, this month, as a market-based exchange rate pricing mechanism for BOJ buying and selling.

The central bank says it is working to further improve high-frequency forecasting of FX flows from corporates, banks, exchange houses, and securities dealers, as well as improved monitoring of the banks’ net open FX positions.

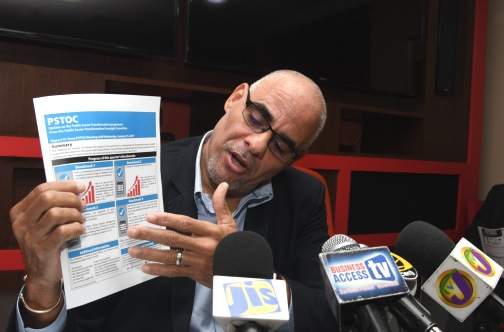

“Right now with the BOJ there is what you call the 25 per cent surrender requirements of what you trade on the market to the BOJ. Now they want to move away from that and have the BOJ buying and selling in the market to build their reserves to supply the market when there is a short in foreign exchange. So they are moving away from reserved requirement into a more efficient market mechanism,” Duncan told media representation during the second quarterly review of the 3-year IMF Precautionary Stand-by Arrangement.

http://www.jamaicaobserver.com/business-report/duncan-confident-about-fx-auction_100540

Leave A Comment