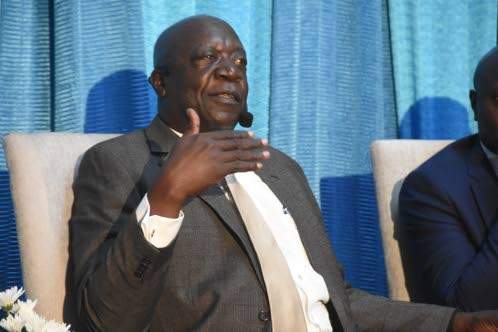

Senior deputy governor of the Bank of Jamaica, John Robinson. ((Photo: Karl McLarty))

THE Bank of Jamaica (BOJ) has secured a deal with international financial and media services provider, Bloomberg (USA) throuh which local traders can utilise its platform to advertise and trade in both local and United States currencies.

The BOJ’s Senior Deputy Governor John Robinson, who made the disclosure, says the move is a further effort to bring transparency to the local foreign exchange market, and is merely an interim measure before the central bank rolls out its comprehensive trading platform set for early next year.

Speaking in an interview with the Jamaica Observer’s Sunday Finance, Robinson informed that “the Bloomberg B-Match model, which is now being tested, allows dealers to post rates on the platform for all to see, as well as to facilitate trading among the dealers themselves”. This new FX trading platform is expected to be activated on July 1.

Already a number of FX traders and big players have reportedly been signed on to the platform, so they will be able to see what the other banks are trading US dollarsfor; through a special terminal which is linked to the BOJ’s central clearing house system.

A fee of US$2,000 per month per terminal is charged by to Bloomberg to access this platform.

Senior Deputy Governor Robinson explained that “if you don’t have a terminal you don’t have access — so dealers will need to have such a terminal to register their big clients who are in need of FX”.

He cited an example “say JPS, which want to buy US$1 million, you can come onto the system and see who is selling and for what price, and you can buy through your dealer who will process the transaction using the Bloomberg B-Match model”.

Leave A Comment