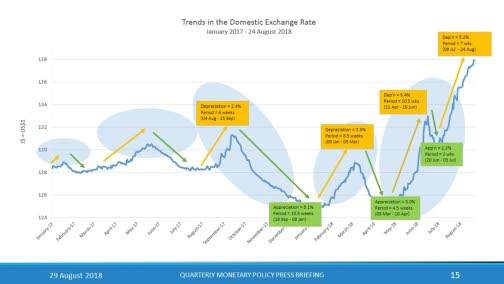

UnsurprIsingly, Bank of Jamaica Governor Brian Wynter’s Quarterly Monetary Policy press briefing last week Wednesday was still dominated by questions about the dollar, with the governor once again denying the “false message” that the Bank of Jamaica had been trying to manipulate the exchange rate to increase inflation.

Instead, he noted that the Central Bank wanted a “freely floating” exchange rate, and advised that Jamaica had already had “a flexible market determined exchange rate” for at least the last three years.

While they were not “managing” a rate, the Bank of Jamaica had a commitment to achieve both a “liquid” market, and a “fair” price between buyers and sellers. He noted that over the last few months there had also been an appreciation of the dollar against “all the other currencies in the world”.

He advised he didn’t know which countries had an absolutely free float with no intervention, but while they were not targeting a specific exchange rate, the Bank of Jamaica retained the ability to make sure “disorderly conditions” don’t emerge. For example, the flash auction of US$40 million was meant to be a “surprise”, and in fact “people were surprised”.

However, he noted he also had to protect the “reserves” of the country, and was “accountable” for the use of those resources. He added that the new B-FXITT mechanism was merely a “tool”, and was not a change in exchange rate policy towards greater “flexibility”. Over time, he expected “on average” for the exchange rate to adjust in line with the difference between Jamaica’s inflation and that of our trading partners.

The governor advised that one of the reasons for the depreciation in the currency was that a substantial amount of debt refinancing had increased the demand for foreign exchange (to pay down the existing US dollar corporate debt), as well as a sharp increase in foreign exchange demand due to imports of capital goods, etc widening the current account deficit.

He advised that local bank lending in dollars was however a “very small” proportion of local bank US dollar deposits, at approximately US$3.5 billion.

http://www.jamaicaobserver.com/business-observer/boj-s-wynter-tackles-questions-on-the-dollar_143399

Leave A Comment