HEY guys. This week I continue the series on de-mystifying some of the terms around investing and making it less scary (and less boring). Our topic today is “dividends”. Just like “stocks” last week, this is another term that everybody and them cousin “know”, but not everybody actually knows. I touched on it a little last week but this week it’s best to give it more depth.

So, just in case you always wondered, or already knew but wanted a refresher, here’s my simplified definition and explanation of what dividends are. Let’s start with a simple one-liner explanation.

WHAT’S A DIVIDEND?

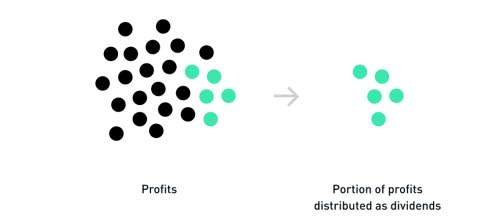

A dividend is a direct payment of a company’s profits to its shareholders.

Boom. That’s the simple version, but now you know.

So, what’s the more complex version? Well, it doesn’t really get too complex, but there are some rules around dividends. Now, to understand the deeper rules, there is one more thing you have to know. In a company, all the profits that aren’t used up (or paid out as dividends each year) get recorded in the company’s books as something called “retained earnings”. Retained earnings are literally what the name says; profits that are kept in storage, also known as, retained profits. They are sometimes called “accumulated profits” or “accumulated earnings” but they are all the same thing; they show how much of previously earned profits a company has kept.

http://www.jamaicaobserver.com/sunday-finance/dividends-a-simple-explanation_166870

Leave A Comment