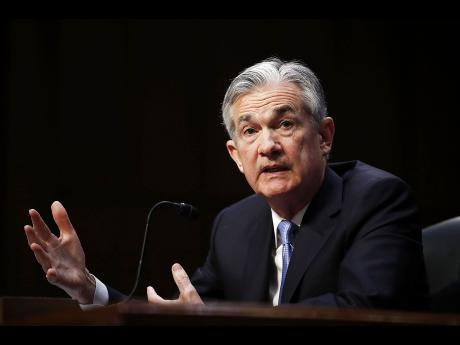

United States Federal Reserve Chairman Jerome Powell cast a bright picture of the US economy Wednesday and appeared to suggest that the Fed might consider a pause in its interest rate hikes next year to assess the impact of its credit tightening.

Powell’s comments ignited a rally on Wall Street, with the Dow Jones Industrial Average surging more than 300 points after his remarks were released.

Referring to the Fed’s gradual increases in its benchmark rate, Powell said “there is no preset policy path.” Rather, he said, the Fed will assess the most recent economic and financial data in deciding whether or how fast to keep raising rates.

Speaking to the Economic Club of New York, the chairman also suggested that interest rates appear to be just below the level the Fed calls “neutral,” where they are thought to neither stimulate growth nor impede it. That contrasted with a remark Powell made in October that the Fed’s policy rate was still a “long way from neutral”.

His remark then had unsettled investors, who feared it signalled that the Fed would continue raising rates well into the coming months.

The Fed chairman also said Wednesday that while some corporate debt loads have reached riskier levels, “we do not see dangerous excesses in the stock market”.

The Fed has raised its benchmark short-term rate, now in a range of two per cent to 2.25 per cent, three times this year and is expected to do so again next month. But the likely pace of rate increases next year remains a subject of speculation.

The rate increases have gradually raised borrowing costs for consumers and businesses. Any slowdown or pause in the Fed’s rate hikes would be welcome news for a stock market that’s been battered by fears that the Fed’s continued credit tightening could end the long bull market. Higher rates tend to slow economic growth over time as well as pressure stock prices.

Leave A Comment