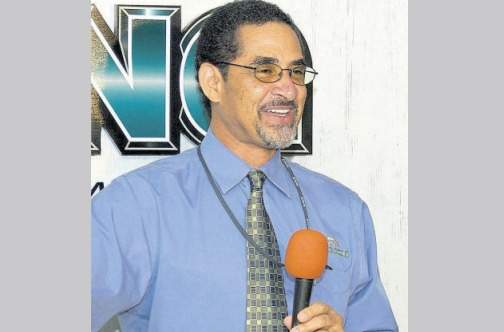

CHARLES Ross, CEO of Sterling Asset Management Limited (SAM), has stated that the reduction in the Bank of Jamaica (BOJ) policy rate and reserve requirements could lead to increased economic activity for Jamaica.

He reasoned that the reduction in rates will spur banks to grow their consumer and business loans while pension funds will seek out investments with better yields.

Sterling Asset Management will interview the Central Bank Governor Brian Wynter and IMF resident representative, Dr Constant Lonkeng Ngouana, on June 19, to discuss in detail the impact of these changes on investors.

The BOJ reduced its policy rate, the rate that sets the interest rates for the broader sector from 1.25 per cent to 0.75 per cent—the lowest in over 30 years.

What’s more, the BOJ reduced its reserve requirement for banks from nine to seven per cent, releasing billions of Jamaican dollars into the financial system.

The BOJ’s monetary policy regime is moving in the right direction, according to Ross.

“Lowering the benchmark interest rate, in theory, suggests that interest rates on loans should also go down,” said Ross. “A lower cost of financing should benefit the economy. The very low yields available on CD’s and Treasury Bills should also incentivise banks to do more lending. It should likewise incentivise pension funds to look outside of traditional fixed income and seek higher risk adjusted returns elsewhere.”

Leave A Comment