Today, I will look at Jamaica’s five oldest unit trusts and mainly the funds which invest primarily in the Jamaican securities market.

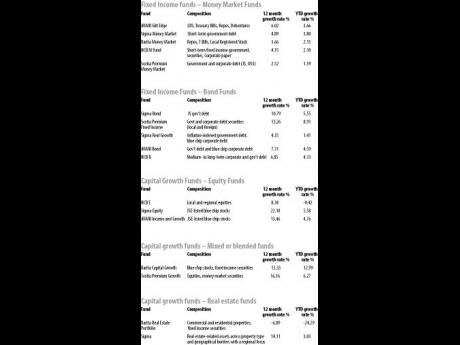

This examination will focus on the composition of the funds, their 12-month growth rate as measured by the percentage increase of their unit values to August 9, 2018, and the year-to-date percentage increase in their unit prices to August 9, 2018 as reported in the Financial Gleaner of August 10, 2018, as laid out in the accompanying graphic.

The funds are categorised as fixed income funds and capital growth funds. The former group comprises money market funds bond funds and the latter equity funds, capital growth funds, mixed funds and real estate funds. These categories, reflecting the types of instruments in which the funds invest, are based on information published by the unit trusts.

– Fixed Income Funds Money Market Funds

Government securities were the preferred instruments although two of the funds listed corporate debt securities as instruments in which they invest. It is worthy of note how different the growth rates of the funds were although they, for the most part, operated in the same market.

– Fixed Income Funds Bond Funds

There is a wide difference in the performance of the funds but these portfolios of long-term bonds did better than the money market portfolios. Of note is that there was a greater inclination to invest in corporate debt instruments than in the case of the money market funds.

One advantage of these funds is that they are capable of deriving returns above current rates when interest rates are falling. When interest rates are increasing, though, there are two disadvantages: the values of the bonds fall and the interest earned lags current rates.

– Capital Growth Funds Equity Funds

These funds invest primarily in equities, but it is not unusual for such funds to invest in a limited amount of fixed income securities. Of note is the wide variation in the performance of the funds with the fund appearing to be spread across more markets recording the lowest growth rate.

Of significance also is the relatively slow growth rate of the funds in the last eight months.

Leave A Comment